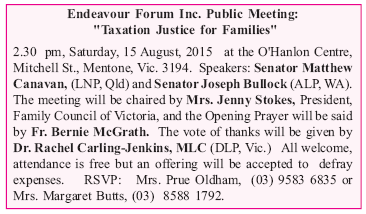

A Discriminatory Federal Budget

While the Federal Budget of May 2015 has some commendable features, it is highly discriminatory against families where the mother chooses to remain out of the paid workforce to care for her pre-school children. Even the rhetoric used is insulting to the mothers who make such a choice - slogans about "working mothers" implies that a mother who provides her own child care is not doing worthwhile work, while the child care worker in a centre is. A headline in the Melbourne Herald Sun (13 May) put it bluntly: "Stay-at-home mums big losers in revamp".

We take this opportunity of reminding Prime Minister Tony Abbott - who is a former seminarian - of the words of Pope St. John Paul ll:

"While it must be recognized that women have the same right as men to perform various public functions, society must be structured in such a way that wives and mothers are not in practice compelled to work outside the home, and that their families can live and prosper in a dignified way even when they themselves devote their full time to their own family. "Furthermore, the mentality which honours women more for their work outside the home than for their work within the family must be overcome. This requires that men should truly esteem and love women with total respect for their personal dignity, and that society should create and develop conditions favouring work in the home." (Familiaris Consortio, 23).

If he ever read papal encyclicals, Tony Abbott probably feels he hasn't time to meditate on them now, but perhaps he should find the time just as he finds the time to be with another disadvantaged group, Australia's indigenous citizens. 'Stay-at-home mums' are usually those with more than the below-replacement level Australian average of l.9 children. Mothers of large families are raising future workers/taxpayers and deserve better than the discrimination in the 2015 Budget and the bullying and coercion to enter or re-enter the paid workforce.

Professional child care is expensive, and a fairer system would be to make it tax deductible. Heavily subsidizing workers and child care centres while discriminating against single-income families is gross injustice and bad economics. Why not, for instance, subsidize workers in car manufacturing or in many other struggling industries? Why not at least allow income-splitting for single-income families as the Canadian government is doing, or allow a double tax-free threshold for single-income families with children under 18 years of age?

Roslyn Phillips, research officer for Family Voice Australia, said "there is a huge omission from the federal budget childcare package - and that is any acknowledgement of - or subsidy for the best childcare of all. Longitudinal, randomized studies continue to confirm what most people instinctively understand - in general, children under two or three do best when cared for by a parent, usually mum".

"Babies and young toddlers who spend a lot of their waking hours in a childcare centre are likely to be more aggressive and uncooperative in later years. Pushing mums of young children back into the paid workforce by paying them to put their kids in childcare is counter-productive. The work these mums do at home may not be paid, but it is invaluable. It is helping to build a nation of cooperative, balanced citizens.

"So why are we punishing families who do their own childcare

work when their children are under three? Why does the

childcare package rely on cuts to Family Tax Benefit B? This

benefit does not even make up for the tax inequity suffered by

one-income families. They receive just one tax-free threshold

of $18,200 - compared with two-income families, who receive

$36,400 completely tax-free."

"So why are we punishing families who do their own childcare

work when their children are under three? Why does the

childcare package rely on cuts to Family Tax Benefit B? This

benefit does not even make up for the tax inequity suffered by

one-income families. They receive just one tax-free threshold

of $18,200 - compared with two-income families, who receive

$36,400 completely tax-free."

"We urge the government to rethink its families package, and we commend Senator Matt Canavan for highlighting the plight of single-income families."

Senator Canavan will be speaking at our next public meeting (see above right). Please remember donations for our Newsletter and fill in your email address and any change of address on the form on p. 13 if you receive the hard copy and post in the enclosed envelope. Please also remember Endeavour Forum Inc. in your Will so you can continue to help us in the future.